At Brandigo we have been pioneers of what we have named data-conscious brand strategy. In our new series of articles, blogs, and podcasts, The CMO’s Guide to Data-Conscious Brand Strategy, we’re going to take a deep dive into what that really means, why it will set your brand and marketing apart from your competition, and break down some of the steps we take to inform the amazing journey we take our clients’ brands on.

But first, a quick reminder:

What is data-conscious brand strategy?

A lot of great organizations are missing out on growth and opportunity because the agencies they work with, and maybe even their in-house teams, don’t commit any time or resource to truly developing an authentic understanding of what their customers actually want. They rely on guesswork, hunches, and generic insights, underpinned by ubiquitous third-party market reports which have likely been referenced by every single one of their competitors as well. This leads to a bunch of stale brands in the marketplace with no one standing out from the pack.

When we hear about “data-driven” strategies, we tend to imagine a room full of supercomputers, crunching and analyzing data to lead us into the future (when they’re not busy beating Kasparov at computer chess). CMOs know that this is not real life. Finding the right data and applying it to real business life is a complicated game.

Here at Brandigo, we believe there is a different way. A better way that makes use of a potent combination of primary research and a creative vision that ensures brands consistently and powerfully speak to what customers care about most. There are no shortcuts.

Speaking with hundreds of customers in tailor-made studies, we uncover the true emotional value a brand’s products and services, as well as defining the gap between what customers say and what actually drives their buying decisions. At the same time, we conduct an audit of a robust collection of your brand’s competitors to ensure that we are not saying the same thing, nor are we visually communicating our brand in the same way. It is truly a hybrid of left and right -brained thinking.

The results shift paradigms. Data-conscious strategy elevates brands above the competition and inspires entire organizations. It cultivates equity—the kind investors, entrepreneurs, and the C-suite fawn over. The kind that leads to real revenue gains and lasting legacies.

So, where do value drivers come in?

For value driver analysis, you are seeking to determine what purchase decision motivators your customers view as important – both consciously and sub-consciously. What are the values that a brand represents that truly impact a purchasing decision? It’s the reasons why your customers choose to buy your products or services over those of the competition. Once you understand which value drivers have the biggest impact on your customers and in your market, and on which your brand performs best in the eyes of the market, you have the foundations for a brand strategy that will really speak to your customers’ wants and needs.

How is it done?

Value driver analysis is based on statistically robust data gleaned from a detailed market survey. Based on this data, you can identify a series of category dimensions that drive the reputation of companies in your space. So, for example, let’s say you are in the car manufacturing industry, these category dimensions could be something like:

Performance

Design

Economy

After-sales ca re

Environmental impact

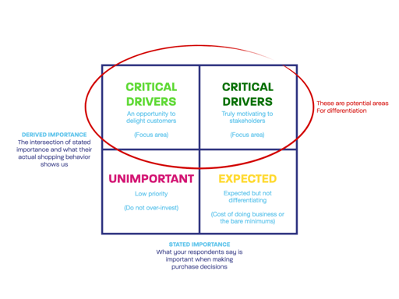

The next step in the process is determining the importance of each category dimension and to group them in one of four sets as shown in the diagram below:

These category dimensions naturally fall into their categories based on the index ratings assigned to them by the collective study respondents. Dimensions that fall within the ‘Delighter’ and ‘Critical Driver’ set will start to give you an idea of the value drivers you can focus on to develop your brand strategy.

Continuing with our car manufacturer example, the data might show that economy is unimportant to our target market and that good after-sales care is expected. However, environmental impact is a delighter and design and performance are critical drivers. So, the foundation of our brand strategy could be positioning the brand as an environmentally friendly vehicle without compromising performance or design.

This anecdotal example just the tip of the iceberg, and Brandigo’s experienced brand strategists will go deeper into the data using advanced statistical methods combined with creative thinking.

Another benefit of this methodology is that it gives you the ability assess how your ‘delighters’ and ‘critical drivers’ resonate with different stakeholders, geographic regions, and so on. Using this data, you are able to then create brand positioning scenarios that are focused on consumer wants and needs and genuinely differentiated from your competitors because you are not relying on third-party data or analyst insights that are readily available to anyone. This approach results in positioning strategies that are unique, authentic, and validated by data.

We’ve just scratched the surface here in what is possible when you conduct powerful value driver research. Studies within different industries will uncover unique, often unexpected critical drivers and delighters. Equally important is that you may be surprised as to what the market views as “expected” or “unimportant.” Sometimes those revelations allow you to reallocate marketing and operational resources to ensure you are achieving the greatest impact by building upon the things that really matter to the market.

What you can see from this is how this aspect of a data-conscious brand strategy uncovers genuine opportunities for differentiation for your brand in a way that resonates with its customers.