At Brandigo we have been pioneers of what we have named data-conscious brand strategy. In our new series of articles, blogs, and podcasts, The CMO’s Guide to Data-Conscious Brand Strategy, we’re going to take a deep dive into what that really means, why it will set your brand and marketing apart from your competition, and break down some of the steps we take to inform the amazing journey we take our clients’ brands on.

And to start things off we shall begin by taking a look at the first stage in the process – ascertaining the health of your brand.

What is data-conscious brand strategy?

Most marketing fails because agencies and in-house teams don’t invest in understanding the authentic desires of customers. So the expensive messaging and content they produce runs wild with irrelevance, often damaging a brand’s health. What they call ‘strategy’ is often a grab bag of semi-educated guesses, lazy attempts to replicate another brand’s wins, and generic ‘insights’ pulled from ubiquitous 3rd party market reports.

Here at Brandigo, we believe there is a different way. A better way that makes use of a potent combination of primary research and a creative vision that ensures brands consistently and powerfully speak to what customers care about most. There are no shortcuts. Speaking with hundreds of customers in tailor-made studies, we uncover the true emotional value a brand’s products and services deliver, as well as the gap between what customers say and what actually drives their buying decisions.

The results shift paradigms. Data-conscious strategy elevates brands above the competition and inspires entire organizations. It cultivates equity—the kind investors, entrepreneurs, and the C-suite fawns over. The kind that leads to real revenue gains and lasting legacies.

Why your brand needs a health check

Measuring brand health helps us to understand exactly how a brand is perceived in the minds of stakeholders, be that customers, employees, competitors, and so on. It goes beyond simply asking if they know of your brand and looks in more detail as to whether or not they know of your brand, and if so, are they compelled to make a purchase for example. It also represents the starting point for developing a truly data-conscious brand strategy.

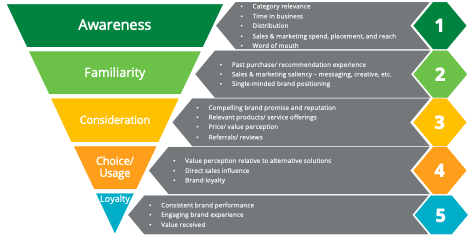

At Brandigo we use our brand health metrics to measure the awareness (aided and unaided), familiarity, consideration, and usage of a brand, as well as exploring loyalty. And we define each benchmark as follows:

Awareness – has the respondent heard of your brand before?

Familiarity – if they have heard of it, do they know anything about the brand beyond just the name?

Consideration – if they are familiar with your brand, will they consider using you if they are looking for a supplier of your products or services?

Usage – is the respondent currently, or have they ever been, a customer of your brand?

Loyalty – how likely is the respondent to recommend your brand?

How does the health check help formulate a data-conscious brand strategy?

Once you have an idea of how aware, familiar, etc., your stakeholders are of your brand, you can then start to make informed decisions about where to focus your marketing resources.

Let’s say our brand health research has uncovered that although your brand has high awareness and familiarity amongst stakeholders, your consideration metrics are low. As you can see in the graphic below, this data would suggest that your strategy should include a focus on developing a compelling brand promise and communicating this effectively to the market. You might also want to examine how your pricing strategy relates to the perceived value your brand is projecting.

In summary, contributing factors to a fall in the consideration brand health metric can include:

A lack of a singular and/or compelling brand promise

A perceived drop in relevance of service offerings

Ineffective messaging or sales saliency

Off-balance price / value perception

Negative PR, product failures, poor reviews or referrals

What this demonstrates here is that just by taking the first step towards data-conscious brand strategy development with a robust brand health analysis, marketing leaders can identify 5 potential points of focus that will genuinely impact on their offer and ultimately their business growth.

The next stage of the process is to focus on your brand’s value drivers. And that will be the topic of our next article. In the meantime, to find out more about data-conscious brand strategy and how it can revolutionize your marketing, get in touch with us via email or join us on our social media.